Fine Beautiful Info About How To Reduce Tax Liability

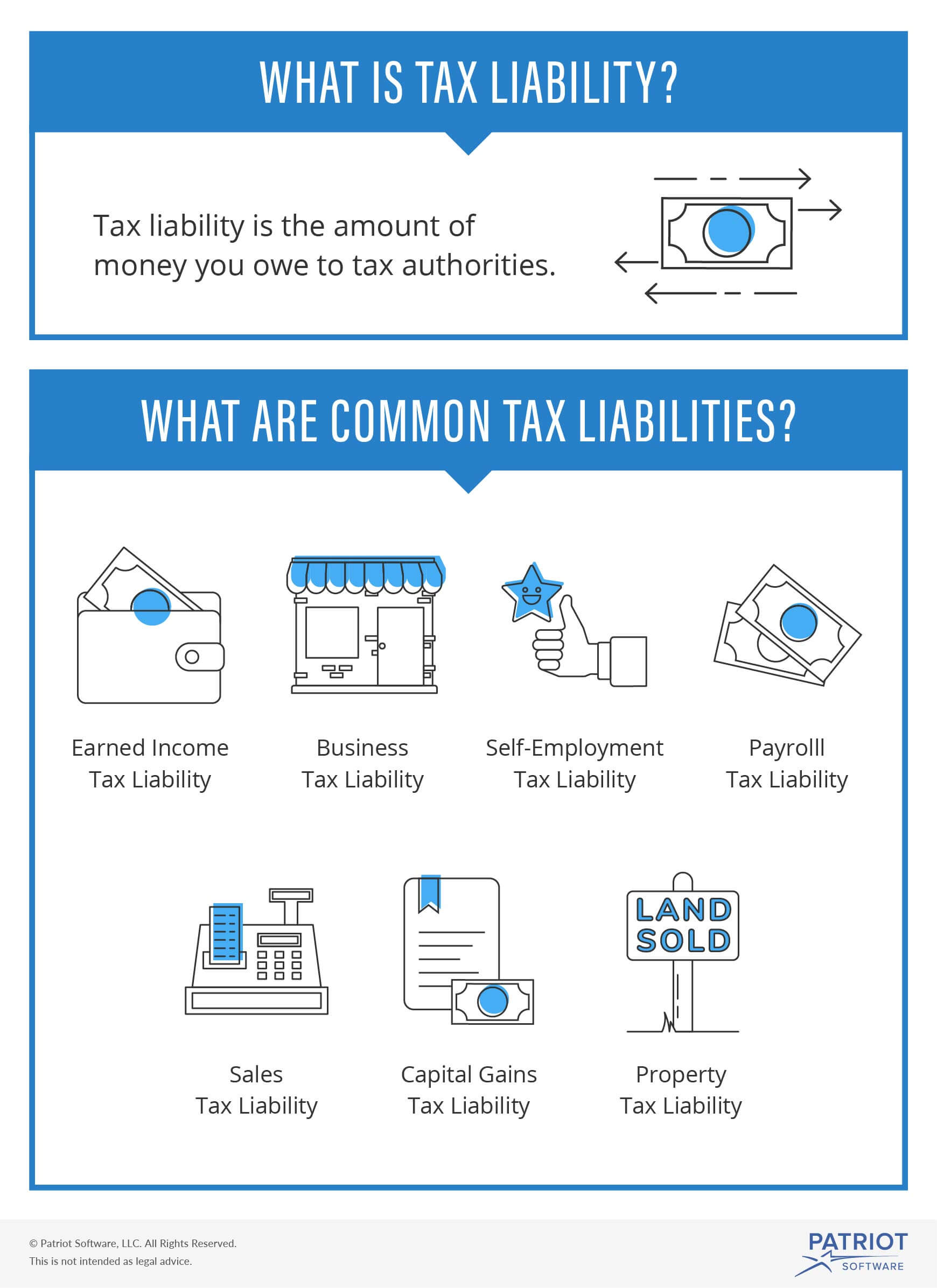

The only way to reduce your tax liability is to lower your net income.

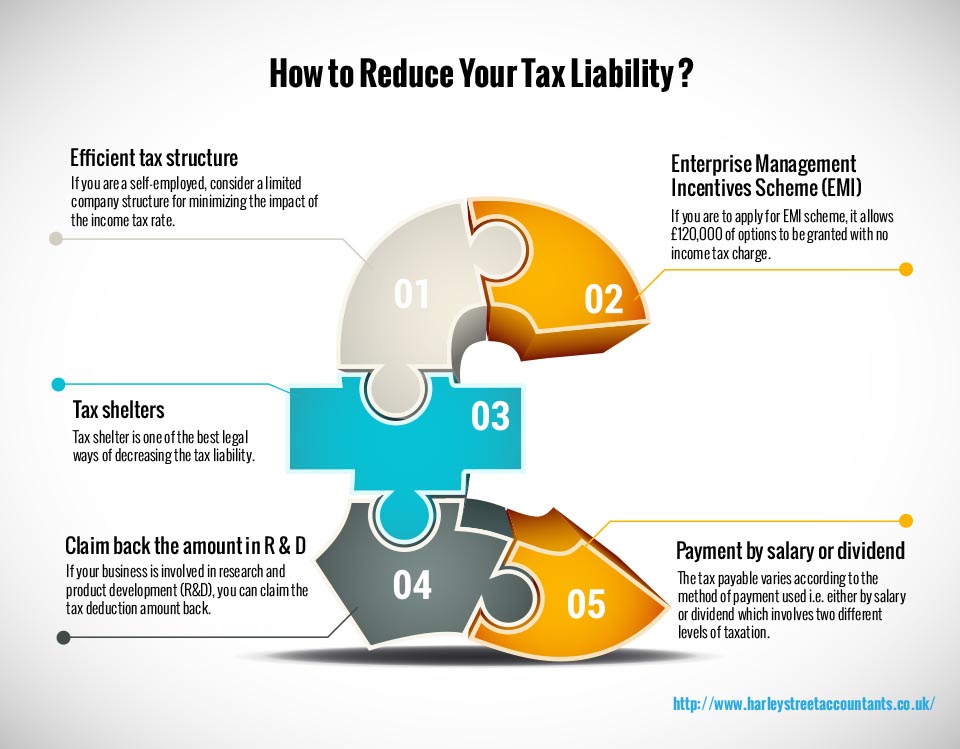

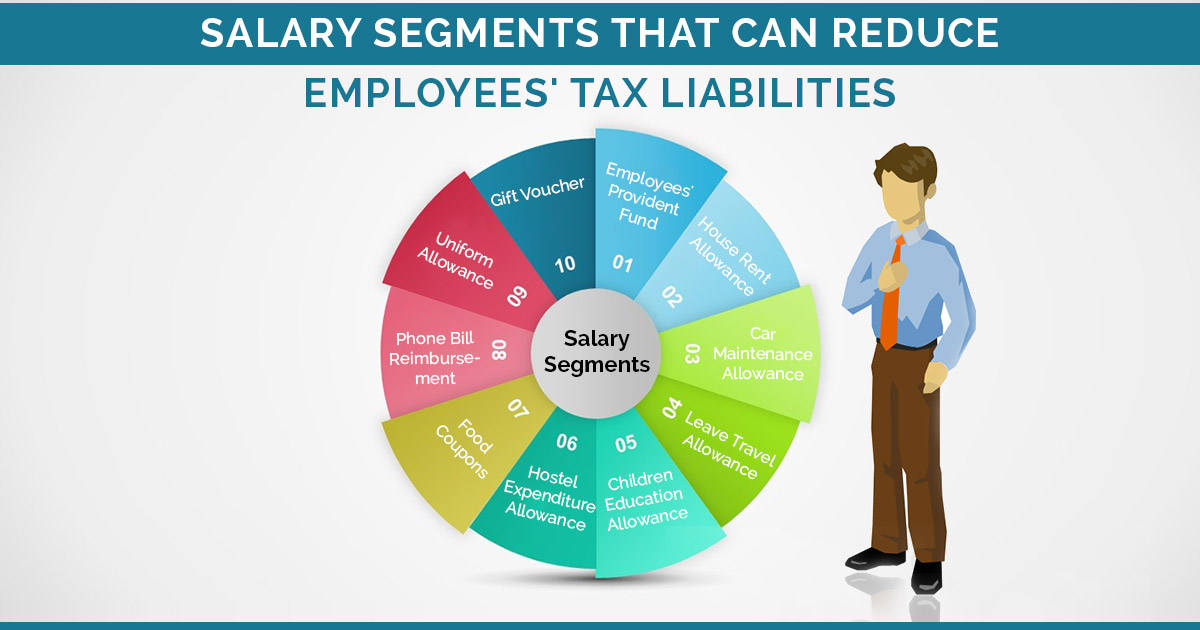

How to reduce tax liability. Here are 5 ways to reduce your taxable income 1. You can legitimately reduce your tax liability by claiming expenses and deductions under various. Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to.

Personal capital’s team of dedicated. Careful tax planning could significantly reduce your tax burden to almost nothing even if you have a fairly high income. Here are 9 ways to accomplish your goal and reduce your tax bill:

Key takeaways the key to minimizing your tax liability is reducing the amount of your gross income that is subject to taxes. One of the best ways to decrease your tax exposure is to pay attention to tax credits as well as tax deductions. One of the easiest ways to reduce your tax liability as an investor is to take a capital.

One of the most straightforward ways to reduce taxable income is to maximize retirement savings. The 2021 tax filing season is here! Increase your retirement contributions to the max.

And, since net income equals gross income minus deductible expenses, only two ways to lower tax. Prepaying for services is another way to lower a corporation’s tax liability. For the purposes of this article, i am going to assume that your tax liability is accurate.

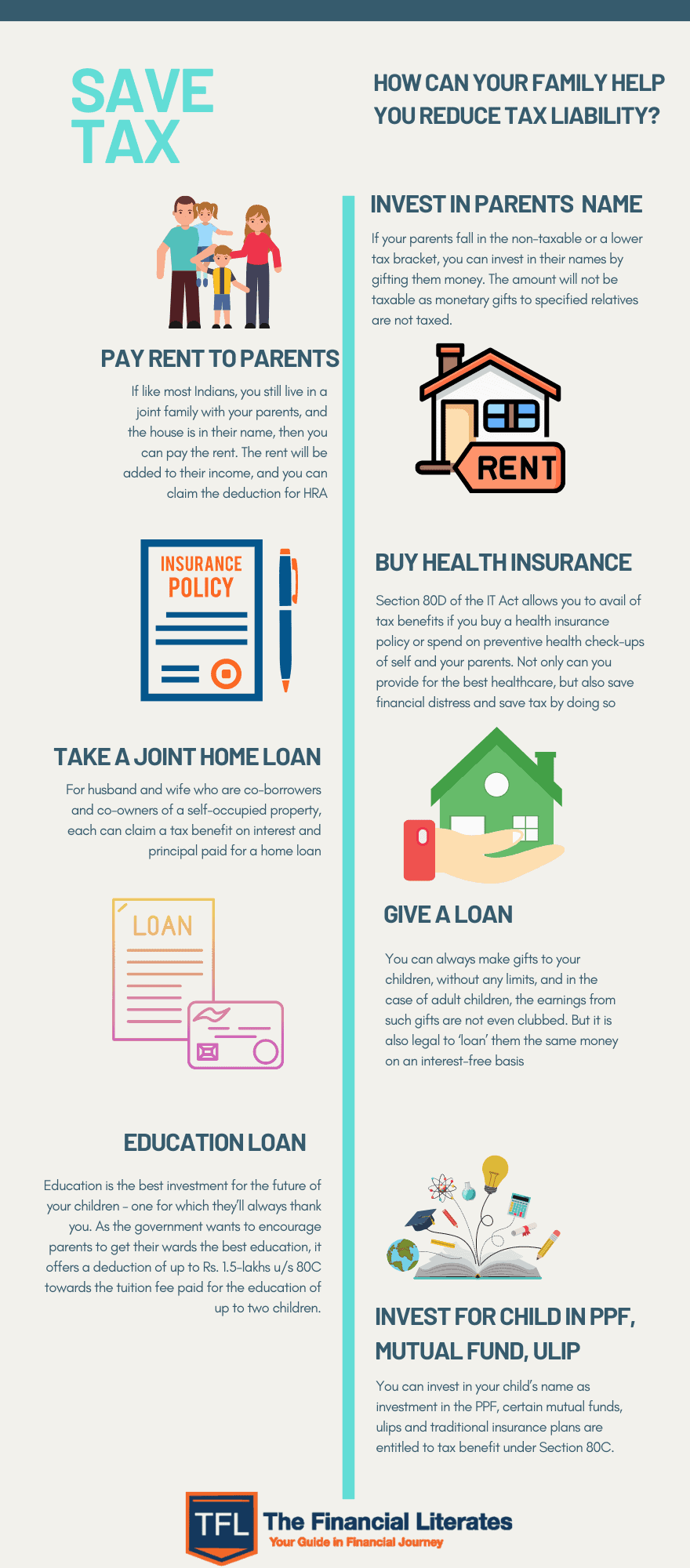

It’s not possible for every small business, but if you hire a family member you can skip some. Unlike tax deductions, which reduce your taxable income,. Through an array of strategies and deductions, consider utilizing these eight tips to lower your tax liability.